How Self-Driving Cars Will Transform Retail & Shopping

This was also published on David Perell’s website.

Introduction

People complain about distracted driving, but driving is the distraction.

The problem with driving isn’t the traffic or that it takes so long to get from my home to work, but that driving gets in the way of living. If we all had self-driving cars, it wouldn’t matter if I lived two hours away from work, so long as the vehicle transporting me has a bed with a built-in entertainment or work center.

There are two ways that autonomous vehicles make driving independent of living:

- The first is they remove the driving, so you no longer have to plan your life around getting to places. Imagine working out in a self-driving gym on your 40-minute commute to work. However, it will be a while before people spend most of their time traveling in driverless cars.

- The second way, which is more interesting as it will happen a lot sooner, is autonomous vehicles in various sizes moving things around. It may be drones, or mini-kitchens with ovens that keep pizza warm, but ultimately, businesses will adopt these little autonomous agents — not just cars — at scale in the next 5 years. These autonomous agents are an invention that enables a way of moving things to people instead of moving people to things.

Driverless vehicles will be serving you long before you sit down in one. They’ll be delivering your goods and deliveries first, and this will change everything about the way we consume today.

The 3 Economies

The retail model is fragile. Every two decades, an invention and its widespread adoption changes the structure of an industry. When this change happens, predicting success and failure of different industries comes down to understanding which players have leverage to take advantage of these changes and capture market share.

We’ll see three of these structural changes in our lifetime:

- The Real Estate Economy. Before the Internet, the main way to gain leverage in an industry was through real estate. Businesses gained leverage by opening up stores in proximity to where consumers already went. It was real estate that propelled McDonald’s into the most popular fast food chain in the country. Starbucks similarly recognized the leverage gained in real estate, which is why they often put two Starbucks within a block of each other. Starbucks wants to eliminate any barrier — even if it is simply crossing the street — to a consumer making Starbucks their first choice for coffee.

- The Internet Economy. In the Internet Economy, businesses gain leverage by offering consumers convenience, which usually involves aggregating multiple suppliers of content and becoming an access point. Spotify, for example, aggregates all music into one place to provide a single hub for customers to listen. Customers are willing to pay $9.99 a month because it is more convenient than buying one song at a time on iTunes, or even pirating individual songs and albums.

- The Self-Driving Economy. As online experiences mature, there will be far less interest in visiting locations as people will instead want experiences delivered to them. Self-driving vehicles, starting with drones, will streamline that, and the businesses with leverage in this economy are those who can take advantage of the transportation infrastructure to deliver a personalized consumer experience. Availability of cheap shipping infrastructure will do for physical stuff what internet streaming did for digital stuff. These changes will drastically shift how we interact with each other and the world around us.

We’ll start by diving into how the Internet is changing two specific industries: entertainment and restaurants, reshaping who has power (the platforms) and who does not (the music producers and restaurant owners). Understanding the Internet Economy will provide a framework for predicting success and failure for retail players in the Self-Driving Economy. Each of these economies will change the structure of different industries.

Self-driving vehicles will transform the retail economy in the same way that the Internet changed the music economy. In the 1990s Real Estate Economy, record stores sold CD albums individually because they lacked data on what customers wanted (at least on the individual-customer level) and distribution costs were high. In the Internet economy, platforms match their troves of consumer data to bundle a personalized offering of content curated just for you. Think an ice cream shop only needing to stock the flavors it knows everyone in town likes. In this economy, the platform uses consumer data to decide what goes into the optimal bundle, but the platform makes the final calls. The Self-Driving Economy will similarly reduce distribution costs like the Internet Economy did, setting up an environment for the same tailwinds in retail. In other words, with lower distribution costs, platforms will overflow with consumers who jump at low prices. They will therefore have abundant data on consumer preferences, which they’ll use to offer you products you love. Just as Spotify can leverage consumer data to make the perfect playlist, more platforms will cater perfectly to your preferences.

The era of consumers doing their own shopping is over. If advertising is an industry driven by nudging consumers into buying certain products and services, then advertising — at least brand advertising — will soon be an industry gathering thick layers of dust. Rather, whoever controls the customers’ go-to access point will influence the product that is delivered to consumers.

The same way Spotify skews consumers’ choice in its Made for You playlists, and Amazon skews consumer choice toward anything it labels Amazon’s Choice, most advertising will be ineffective in displacing the bundle these platforms chose. In a Self-Driving Economy, single-buyer platforms will do all the shopping. As we’ll see later, the lower distribution costs associated with these cars will make it possible for one platform to buy all a consumer’s products for them.

The Real Estate & Internet Economy

To understand how the Self-Driving Economy will change the food and retail industry, we look to the Internet’s transformation of the music and movie industry. The key variable the Internet changed was making the cost of distributing digital content near-zero.

For an example, let’s take a look at how the Internet Economy transformed the music industry. The raison d’etre for record labels in the music industry used to be distribution. If you were a musician in 1990, you could not invest millions of dollars into a factory to produce discs and then ship them to your customers around the world. So, in the Real Estate Economy, the role of the labels was obvious. Making and distributing records was a capital-intensive task that included significant investment in production lines, channel investments, and logistics. Now, a platform like Spotify handles the distribution. Record labels are still important, but for other reasons — now they function more as influential venture capitalists, identifying talent and molding them into a perfect production for the taste of the masses.

The Internet enabled a player like Spotify to rise up, essentially becoming a virtual record store with none of the high rent payments and CD inventory and all of the benefits of zero-cost distribution. Similarly, the same economic incentive structure powered the rise of Netflix.

The Rise of Bundling in Entertainment

In the Real Estate Economy, if a consumer wanted to watch a movie, they would go to a theater or local VHS store and decide what to watch. In the Internet Economy, a consumer pays Netflix $9.99 a month for a package of shows and movies and entrusts that Netflix will determine the best way to use that money to entertain us. In turn, Netflix pools together our subscription payments and decides whether that pool is best spent on streaming rights for Seinfeld, which would cost $500m, or whether the funds would be better spent producing an original satirical cartoon about a self-loathing horse named BoJack.

Real estate doesn’t obey Moore’s law — subscription bundles are profitable only under the environment the Internet creates. What’s interesting about the Internet, compared to the Real Estate Economy, is that the marginal cost of adding an additional good to a package is zero. When it doesn’t cost much to stream one more movie to someone, it’s a better business decision to bundle movies as a subscription package for customers. Businesses love selling subscription bundles over selling individual items, because it means they get recurring revenue from customers, and don’t need to spend money going out to acquire new customers every month. It’s more expensive to acquire a new customer than to retain an old one — a high customer acquisition cost (CAC) is a tax so heavy it’s led to the downfall of many startups (for example, Casper invests $305 to acquire a customer that spends $754). In the Real Estate Economy of record stores and movie theaters, however, it would be an unwise business decision to offer a subscription bundle to customers.

Let’s say you run a movie theater and want to move from a ticket model to a monthly subscription model in hopes of increasing profits. How much could you price your subscription at? You charge $30 for unlimited movie access, because you still need to pay movie studio fees. You will see a spike in customer demand, but you’ll also be paying movie studios high fees for customers who are watching a lot of movies. This business model starts to sound familiar — read about MoviePass hemorrhaging cash — your high fees to the movie studios have strangled your business.

The Internet spawned an infrastructure layer that enabled businesses to collect user data and leverage it to offer a better customer experience through personalized recommendations. This is obvious.

What is more interesting is what happens on the business’s income statement. Now, not only can businesses now offer a more personalized customer experience, but they can also use the data to figure out what content to buy and how much to pay for it, giving them an upper hand in negotiations compared to movie theaters. This insight means that Netflix can predict what content will be popular and thus what they’re willing to pay for and leave unpopular content on the table, making their business more viable.

High shipping costs strangle the growth of storefront businesses. When a record store needs to pay $5 per album in its inventory, selling albums individually to customers is the best business decision. If that cost suddenly drops, and business instead only needs to pay $0.03 for an album, then the unit economics change. A business could instead lock in customers for a $9.99 monthly subscription and provide a better experience by offering unlimited access to an entire music catalogue. This decrease in the cost of getting an album to customers from $5 to $0.03 is a simple cost reduction, but it drastically puts the leverage in favor of the platform rather than the content producer. The Internet unlocked two variables that shifted power from music and movie producers to platforms like Netflix and Spotify

Shipping and delivery make up a significant portion of the cost structure of d2c companies. The top costs for a d2c business include cost of materials, packaging, merchant fees, and shipping. Merchant fees typically shave 2-3% of each sale, and shipping costs can be anywhere from 2% (for an expensive engagement ring) to over 50% (for a cheap t-shirt) of a sale. These fees have grown aggressively as consumers have grown accustomed to overnight and 2-day shipping. While merchants can push off the delivery costs to customers as a shipping fee, delivery options can make a big difference to a business. Two-thirds of customers choose a particular retailer over another based on the business’ delivery options.

Now that we’ve covered how successful platforms are able to create better consumer experiences, I will spend the next section discussing how The Self-Driving Economy cuts the costs of distributing physical goods, and the downstream impacts of that.

The Self-Driving Economy

Think about your favorite restaurant that no longer exists. Why did it fail? Odds are, it wasn’t the food. Ice cream is always popular and everyone loves burgers. The problem was likely the restaurants’ inability to drive guest experiences (top-line) and inability to increase operational efficiency (bottom-line) that caused instability and ultimately, financial insolvency.

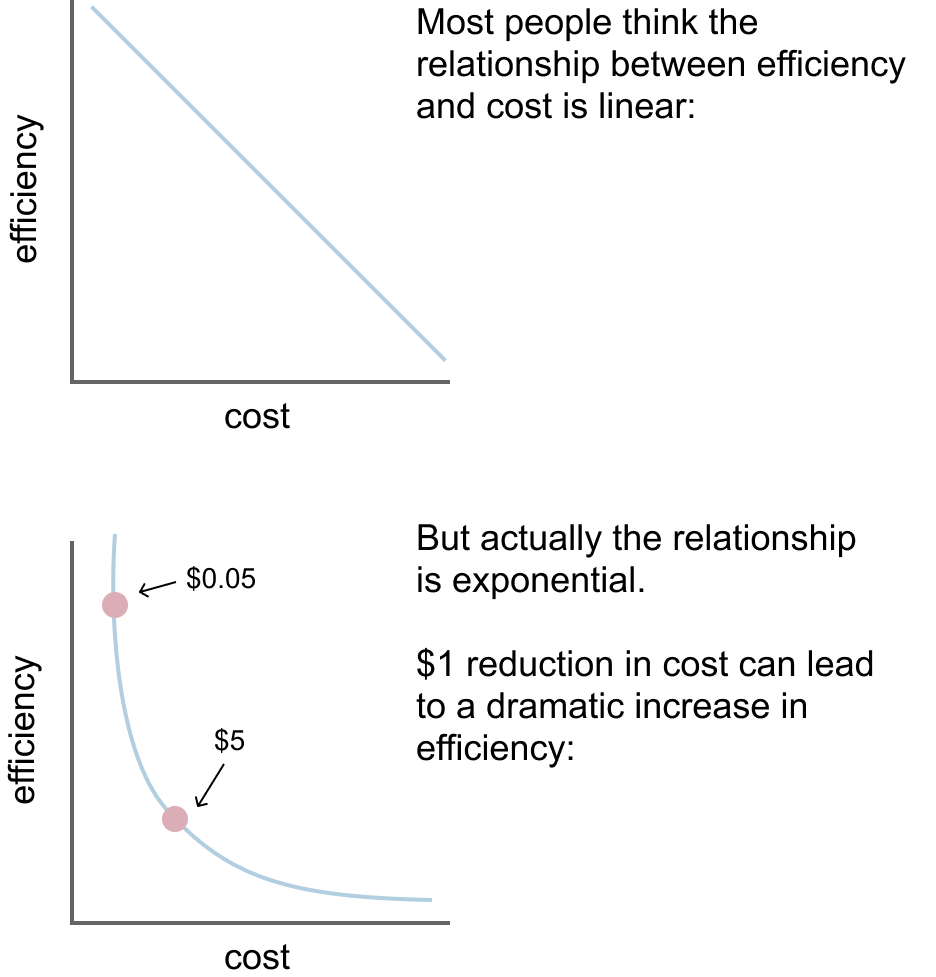

Efficiency is all about getting more of what you already have. A business needs to optimize assets and improve utilization if it wants to survive. Most people think that the relationship between efficiency and cost is linear. One dollar cheaper for a business translates into more efficiency. But the relationship is actually exponential — one less dollar is linear until it is exponential and unblocks a stream that turns into a waterfall. Efficiency increases by leaps and bounds.

The Self-Driving Economy creates a layer of electric, autonomous infrastructure that decreases costs — for example, Amazon recently purchased 100 of Rivians electric trucks to cut their shipping costs. With that cost reduction comes increased operational efficiency. This increased efficiency will in turn power structural change in the CPG industry.

Catalyst: Near-zero Shipping Costs

One of the key ways autonomous vehicles increase efficiency is delivery drones, which greatly reduce the cost for last-mile deliveries. While typical UPS and FedEx ground delivery may cost upwards of $6 for delivery from a local distribution warehouse, drone delivery could be as cheap as five cents per mile. Companies such as Zipline and Intuitive aim to be the first to market with autonomous delivery drones.

In a drone delivery world, consumers enjoy low cost and convenience, while retailers stand to make considerable profit. ARK estimates that a drone could deliver a package in less than half an hour for $0.25, cutting the cost of domestic shipping by over 90%. Given frictionless and inexpensive delivery, consumers would buy more goods online, growing ecommerce’s share of retail sales from 14% in 2019 to 60% in 2030.

Drones are coming

Amazon made their Prime Air delivery drone announcement in 2013, and they are still yet to launch a product, leaving people wondering how far away drone delivery really is. There are several challenges facing the widespread adoption of drone delivery, namely (1) energy density and (2) regulation.

Energy density (watt-hours/kg) has been one of the major challenges in drone technology, keeping drones from being able to go long distances while carrying heavy packages, but innovations in battery chemistry has been improving with time. Amazon, which recently received approval from the Federal Aviation Authority (FAA) for Prime Air, says that it’s drones can deliver packages that weigh up to five pounds, which accommodate for 86% of the products it delivers today.

Currently, drones cannot efficiently carry heavy packages, so the first use cases of drones have been primarily to deliver medical supplies, which Zipline has been doing in Africa. Medical supplies are the perfect first use case because medication meets three criteria.

Criteria for first use cases for drone delivery:

- Compact: Something that is small, lightweight, and thus doesn’t require a lot of power to transport. Transporting a bottle of pills requires less energy than transporting a Macbook.

- High value to the recipient, but low value to anyone else: Security is a concern for drone deliveries, as it’s more challenging for a drone to get a package delivered in a precise location. Medication, on the other hand, doesn’t need to be secured in a specific location. No one is going to steal a package of medicine like they would a package of expensive electronics.

- Time-sensitive: Drones are good for use cases where you need something delivered immediately. Additionally, this makes the case for speedy regulation easy.

Regulation is the other major bottleneck to widespread drone adoption. It would be problematic to have hundreds of autonomous agents flying around without any standards about air space use. The FAA has expedited drone-related regulation to alleviate the coronavirus crisis. UPS, for example, just announced that they would start using Matternet, a drone delivery system, to start transporting medicine to a retirement community in Florida, which is much safer than human delivery during a pandemic. Zipline has used its drones to deliver personal protective equipment in Ghana, acting as a centralized distribution arm during the pandemic. In general, policymakers have been moving faster and green-lighting projects to get medical supplies delivered via drone — regulation that would ordinarily have taken years.

Given the combination of power density and regulatory constraints, I estimate the timeline for widespread adoption of drone delivery at 10 years.

Electric vehicles have already arrived

Even before drones are widespread, electric vehicles, which are much closer to commercial use, will drive down the operational costs of trucking by ~30%.

One of the key ways electric, autonomous vehicle hardware increases efficiency is by making shipping dramatically cheaper as they run from electricity over gas. A gas-powered car costs on average more than four times as much as an electric car. We generally think of electric cars as being good for the environment and a good deal for consumers because they no longer have to pay for gasoline, but we forget the enterprise side — electric trucks will eventually transform the delivery and logistics industry.

As any CPG company knows, shipping and returns is one of the most costly parts of any retail business. If a product is expensive to ship, expensive to produce, or simply not popular enough, it can sink a brand. Shipping costs have traditionally been passed onto the consumer in the form of a $10 shipping fee, but as Amazon’s free, one-day shipping puts pressure on retailers, retailers have been responding by pricing shipping costs into the product and offering free shipping to make sure they can meet shoppers’ delivery expectations.

Most goods are delivered via truck — over 70% of goods in the US. The average trucking cost per mile in the US is $1.82. If a truck drives 100,000 miles, a company spends $182,000 to put that truck on the road. Twenty percent of that number is spent on fuel alone. Another 10% is spent on maintenance and repair. CPG companies are well aware of the opportunity in cost savings to electrify their fleet. Amazon plans to purchase 100,000 of automotive technology startup Rivian’s all-electric delivery trucks.

(American Transportation Research Institute)

In addition to fuel costs, maintaining an electric vehicle is orders of magnitude simpler. The average cost to operate an EV in the United States is $485 per year, while the average for a gasoline-powered vehicle is $1,117. Electric cars are cheaper to maintain and service because they have fewer moving parts and don’t need oil changes.

Additionally, self-driving electric cars will decrease shipping costs by cutting drivers’ wages. At 33% of the cost per mile, this is the most significant cost reduction for distribution.

The cheaper costs associated with getting a good from say, Seattle to San Francisco, mirrors a customer streaming an album rather than going to a record store. The Internet distribution infrastructure fueled the rise of businesses like Spotify and Netflix, and in much the same way, cheaper shipping costs will give rise to new retail businesses who are able to take advantage of the infrastructure.

Downstream Impacts of Near-Zero Shipping

Affordability makes things that previously seemed impossible possible. When autonomous vehicles transport goods, they will lower one of the biggest cost centers for retail businesses.

In many circumstances, a cost reduction is not always meaningful. The scenarios where a cost reduction will exponentially impact economic value requires two criteria to be true:

- (1) The cost reduction is a variable cost: If I run a factory and I have to buy new equipment, negotiating a piece of equipment from $300,000 to $150,000 is a nice discount, but it’s a one-time change without any lasting impact. For a cost reduction to be meaningful, it first has to be a reduction in a variable cost.

- (2) The cost reduction has industry-wide impact: But variable cost alone is not sufficient. If I used to pay $10 for a microchip to manufacture my widget, and now I’ve negotiated it to $5, that’s a great deal. It will have lasting impact for my business over time, but is not meaningful across the industry. The cost reduction cannot apply only to a single company — it also has to apply across an industry.

The value of Amazon Web Services (AWS) is undeniable — they’ve enabled many businesses to exist when it used to be near-impossible. AWS sells cloud computing services, allowing businesses to buy storage space for a database, bandwidth to host a website, or processing power to run complex software remotely. Before AWS, starting a web company would require hundreds of thousands of dollars of capital investment for a business to run and maintain its own data centers. Alternatively, a business could track down a server provider and rent space, but there was no flexibility to scale up and down (Twitter used to fall down all the time for this reason). The AWS infrastructure enabled a pay-as-you-go model, and it meant that if you wanted to start a web company, you didn’t need hundreds of thousands of dollars in your bank to build a data center — you could simply sign up for AWS and spin up a server. In the same way, existing businesses and new businesses will be able to leverage the Self-Driving Economy’s cheap transportation infrastructure.

As the marginal cost of delivering an item for a business gets reduced, it becomes more and more enticing for the business to bundle goods as an optimal strategy (I will not dive into the economics here; for the economic explanations and formulas, see this Chris Dixon post or Brynjolfsson’s academic paper). As a business moves towards an optimal pricing strategy, they serve more customers, and in turn accumulate more consumer data to better tailor their products, enabling them to gain leverage and increase market share. Consider the example of the record store on the street corner who might have 200 patrons walking in every day, compared to Spotify, whose price model enabled millions of customers, each bringing additional data that help Spotify grow. So Spotify gets 150 million users coming in every day compared to the mere hundreds at the store. The scalability of Spotify’s model enables high volume, which pours the concrete foundation for dominating market share and creating a flywheel effect — case in point: Spotify signing an exclusive deal with Joe Rogan.

Structural Changes in the Restaurant Industry

The Self-Driving Economy will transform the restaurant industry by providing cheap transportation infrastructure. With our favorite restaurants and retailers closing everywhere, COVID-19 has awoken us to the slim margins of retail businesses — but these issues are not new. Retailers have always had razor-thin margins, and restaurants especially have a confluence of pressures that drive down their profit margin. For a restaurant’s incoming revenue, labor may cost 40%, ingredients may cost 40%, and rent may be 15%, leaving the restaurant itself with as little as 5%.

If you are a restaurant owner, then putting your business on a delivery app like GrubHub can help bring in extra business. Their restaurant onboarding website highlights reviews from restaurant owners like Simon Mikhail from a Chicago pizzeria who partners with GrubHub.

For restaurants to make up their high costs, they can focus on improving their table turnover or adding new seating, but the rise of delivery providers like Uber Eats, Postmates, and Grubhub are starting to make it more attractive to get rid of seating space altogether and become a delivery-only restaurant.

In the Real Estate Economy, the restaurant industry took the form of brick and mortar restaurants. In the Internet Economy, the delivery app business took off, leading to the rise of platforms like DoorDash, Caviar, UberEats, that allowed customers to order their food online from a restaurant and then would deliver their food to them. The Self-Driving Economy will unlock another structural change in the restaurant industry by providing a cheap transportation infrastructure that will enable the rearrangement of commercial real estate.

Few people know more about the future of urban transportation and real estate than Travis Kalanick, former CEO of Uber. Travis’s new company is called City Storage Systems. The company is focused on figuring out the next big opportunities in the transportation revolution, which is in retail and real estate. One of the company’s first products is a little business arm called Cloud Kitchen. Cloud Kitchen is betting on a bold claim that there is a new kind of food consumption. Rather than people cooking food at home or people going to the restaurant to have food cooked for them, the restaurant makes the food somewhere else and then delivers it to the customer. Food delivery has always been done for things like pizza and Chinese food, but little else, because there was not a critical density of transportation available.

Additionally, the demand hasn’t been aggregated enough to make money for your local German restaurant. Delivery-as-service has expanded the distribution channel for these niche restaurants that were previously only accessible if you had sufficient demand to incur the cost of hiring a delivery team. As a true variable cost, delivery is now attainable, even for the German cooks.

Let’s say you are a cook or a restaurant owner. Now, instead of renting an expensive restaurant with tables, a waitstaff, and an expensive storefront on a popular street corner, you rent space in a Cloud Kitchen that is out by the highway in the suburbs and you cook. You crank out meals and then UberEats generates demand for you. The economics of this business is much less like a restaurant and much more like a manufacturing factory. The factory won’t be downtown with the expensive cost per square foot and high labor costs — it will be somewhere cheap and sprawling.

For Cloud Kitchen restaurant owner Eric Greenspan, who recently launched his delivery-only restaurant Chino, his expenses were 75% less than he would have paid with an expensive brick and mortar location. He’s already launched three delivery brands. Because the platform reduces his failure of risk, he can experiment more freely — if a brand doesn’t work, he just turns off the delivery app.

The layer of cheap infrastructure created by the Internet and the Self-Driving Economies (near-zero cost delivery) reduces operational costs and gives rise to a new business model in the restaurant industry — the ones without a storefront. In the Real Estate Economy, failure in the restaurant business is 60% and requires heavy investment in rent payments and labor costs. In the Internet and Self-Driving Economies, failure for cloud restaurants is cheap, experimentation is easy, and the likelihood of success is high.

Structural Changes in the Fashion Industry

Let’s talk fashion. Fashion is another industry where we’ll see widespread structural changes. First, EV/AV will reduce shipping costs, which will have several downstream effects. The first is that it will enable platforms to grow as they are no longer as cost-constrained. Second, as they acquire more customers, the spike in consumer data will enable them to improve the customer experiences.

Stitch Fix, an online styling service, is an example of a company well-positioned to take advantage of this delivery infrastructure, with a few caveats. Stitch Fix caters to busy consumers in their 30s-40s who struggle with shopping and want a personal stylist to tell them what looks good. A customer tells their online personal stylist what kind of styles they like, maybe an inspiration board, and then pays a $20 styling fee for Stitch Fix to deliver a curated box of clothes to their door. The consumer chooses what to keep, and for pieces they don’t like, they ship them back in an easy return and along with notes to the stylist for feedback next time. Here’s how they can improve in the Self-Driving Economy.

#1: Use data to enhance the guest experience (top-line growth)

Stitch Fix is driving towards our first variable — driving a curated customer experience through gathering feedback about what a consumer likes and doesn’t like. While Stitch Fix is starting on curating individual customer styles, over time, they will accumulate more and more data and be able to create profiles and user models of what a 40-year-old mother in Tennessee would want to wear compared to a 30-year-old lawyer in New York.

Stitch Fix is not perfect at this yet. Despite Stitch Fix hiring thousands of stylists, they still have not been able to deliver successful matches to consumer tastes. Online retailers typically experience a 20-25% return rate whereas styling services like Stitch Fix and Trunk Club have an 80% return rate. One customer’s scathing review of Stitch Fix mentions:

All of my excitement came to a screeching halt when I opened my box to find absolutely nothing to my taste, size, or fabric liking. I was so sad. All of the items were way too dressy for me – I don’t even get dressed up like this for church!

This criticism is not on the product itself, but rather on its execution. However, curating the perfect set of clothing for consumers is something that will take only a matter of time. To see how far away Stitch Fix still is from its ideal state, consider where Facebook was 10 years ago. Facebook’s ads business is a billion-dollar machine now, but when they were first starting out, they had trouble targeting ads to users.

In the book Chaos Monkeys: Obscene Fortune and Random Failure in Silicon Valley, an early product manager for Facebook Ads describes their team’s attempt to build a pipeline to target users. He mentions that despite all the Facebook user data their ads targeting team ingested, they saw no increase in clickthrough rate (CTR), the top metric to gauge how an ad is performing. Facebook’s initial ability to understand its users were despicable:

Using geographic data to discern whether someone is traveling far from home, and then hitting that person with ads for the “travel-intender segment” — that is, the flavor of an affluent business traveler who needs greater access to airfare and hotels? Nope!

…

Our simple heuristics were not locating the guy with the corporate AmEx and a love of legroom and minibars.

Facebook could not improve their ad targeting performance, despite any amount of user data. This was surprising for a company at the scale of Facebook, which had over 750 million users at the time. Eventually, Facebook was able to separate the signal from the noise and build a $15 billion money-printing machine. By the same token, Stitch Fix currently only has 3.1 million users. The more customers sign up and enter their style preferences and feedback, the more user data Stitch Fix will collect, enabling them to deliver on high-quality targeted bundles and earn consumer trust. It’s the same way Netflix has become the go-to destination for film and show entertainment.

#2: Reduce costs to avoid going out of business (bottom-line growth)

In order to win in its vertical, Stitch Fix needs to not only create a curated user experience. It also needs a step-change impact in its operational efficiency. There are two large cost centers for a styling service: (1) curation cost and (2) delivery costs.

1. Curation costs: Having a personal stylist select clothing for millions of clients seems expensive, but Stitch Fix’s stylists are remarkably efficient. Stitch Fix hires thousands of stylists, and each stylist serves an average of 650 customers.

2. Delivery costs: The second cost center, shipping and returns, is a bottleneck for Stitch Fix and any retailer that wants to do business online. Currently shipping and handling accounts for an average of 30% of the cost of an item. Electric, self-driving infrastructure provides a cheap transportation infrastructure that enables businesses to drive their costs down. Let’s look at the details of this process.

Infrastructure as a Propellant

You get rich in business by building a good business model that makes a product customers want and sells it for more than it costs to make. If you do this well, and you’re able to sell lots of units that you spend less than you get for selling them, and make money. The more you can cut your costs and extend your runway, the higher probability of success.

The golden rule in business: “Don’t run out of money.”

The Self-Driving Economy enables CPG business models to succeed by allowing them to not run out of money and speed their time to market. The creation of infrastructure is key here. AWS created compute infrastructure that flipped the business and startup model on its head. When you’re spending less money as a business, you get more shots to play the game. As businesses get more shots, enterprises and startups are now more willing to take risks on new business ideas, because the cost of trying a bunch of different iterations is much lower in AWS and the cloud. For enterprises, this is a new business mode, one that can help them operate more like a startup — lower costs to start a project, faster product-market fit, agility, and low headcount.

Operational Excellence

At the core of this is operational excellence, which implies two things: (1) delivering continuous improvement in customer experience and (2) driving productivity, margin, and efficiency. The best way to drive one of these is to deliver the other.

In the Self-Driving Economy, cheap transportation infrastructure yields faster delivery times and lower delivery costs. These, in turn, improve customer experience and build brand, which in turn decreases customer acquisition and retention costs. For example, as Stitch Fix cuts costs, they’ll have more capital to invest in making better recommendations for customers and drive their top-line growth.

The Self-Driving Economy

Imagine, instead of going to a grocery store every week, Instacart sends you a packaged grocery delivery. Instacart knows exactly what you want and routinely sends you the perfect assortment of groceries without error. You’ll have a grocery subscription service, a clothing subscription service, and a home goods subscription service.

Why doesn’t this model currently work? Two reasons:

- Insufficient data to provide a personalized bundle: Instacart doesn’t have enough data about what consumers want.

- Cost of making a mistake is high: It is currently very costly when Instacart does get it wrong. Return shipping is expensive and Instacart will have to deal with restocking the items.

In the future, cheaper shipping will remove the barriers associated with these two issues. As drones and fleet electrification drive down shipping costs by 40% – 90%, we’ll see retail supply and demand impacted in two ways:

1) Supply:

- For large sellers such as Amazon and Wal-Mart, reduced costs mean the cost of iterating and experimenting with new products is lower.

- For small sellers, we’ll see small players who couldn’t play the game before now able to enter the game because playing will no longer be as cost-prohibitive (think renting an expensive storefront vs. cooking in your own kitchen).

These two factors from large and small players will translate to more goods in the marketplace.

2) Demand:

For consumers, merchants will pass down their lower costs to consumers and produce more goods in the marketplace, meaning consumers will buy more things.

China has great examples of what happens to businesses when delivery is dramatically cheaper. In China, Meituan, the largest food delivery service, has reshaped city life. In Beijing, many people order takeout even if it’s just a cup of milk tea. Meituan charges $1.46 for a bean curd dish, a third of the price on the restaurant’s menu. Many of Meituan’s customers are students who live in dorms without their own kitchens — but even if they did have kitchenettes, it would be tough to beat Meituan’s price by making the dish themselves.

Meituan can command lower prices from restaurants because the demand they can generate for restaurants is so much greater. Food delivery costs $5 in the US compared to $1 in China. China’s economies of scale (the average urban area in China is 8x the population density of your average US city) has dramatically changed people’s relationship with food and restaurants.

Cheap delivery enables the product offerings to change. New entrants can now enter a market that was cost-prohibitive for them before — in the US, most vendors on UberEats are restaurants, but in China, most vendors on Meituan (China’s equivalent) are home cooks.

The Rise of Trusted Curation and the End of Advertising

This confluence of increased supply and increased demand will lead to more data. Large players and retail aggregators (Amazon, Wayfair, Stitch Fix) will collect more consumer data, which will give them more signal on what consumers buy. This is what advertising platforms are already doing.

In advertising, two things matter: intent and signal. An intent is what a user wants or needs in that moment — buying a new car, a dress for a wedding, a comedy movie — and when someone searches for something on Google, posts a picture on Facebook, or reads an article by their favorite influencer, they leave signals – akin to virtual bread crumbs all over the Internet. These breadcrumbs leave advertisers with clues about what a consumer is in the market for.

As companies accumulate data, they will more accurately serve goods that match consumer preferences. Many companies already do this even though it doesn’t seem like it. Spotify may seem like just a music player — easy to dismiss its influence in consumer choice. It is comforting to believe that Spotify is simply a convenient, self-serve platform. While Spotify started out as a simple music player, they have evolved beyond their infancy. The way we used to discover music was through friend recommendations (remember sending friends MP3s back and forth on AIM?) and ads (long gone are the days of MTV and Now That’s What I Call Music ads). But now, music discovery is increasingly through playing something you like on Spotify, and then having Spotify play a music recommendation or serve you a “Made for You” playlist. Spotify’s place in our lives is rapidly shifting from music player to tastemaker.

This is not unlike the shift we will see for Stitch Fix. To illustrate how platforms make the shift, Benedict Evans, a former partner at Andreessen Horowitz, talks about how many important technologies started out looking like expensive, impractical toys. The engineering wasn’t finished, the building blocks didn’t fit together, the volumes were too low and the manufacturing process was new and imperfect. This is where Stitch Fix is. Stitch Fix looks like a toy service, having only 3 million users with a poor recommendation engine and a 30% retention rate.

Stitch Fix gains leverage once it can (1) deliver a customer experience (through collecting signals about what their customers like) and (2) decrease its high shipping costs. Once Stitch Fix delivers on these two objectives, the second-order effect is that they can effectively cut out any advertising — consumers don’t turn to ads to decide what to buy, because they instead outsource their decision-making to Stitch Fix. Currently, consumers buy clothes based on brand loyalty, price, and quality. In the future, the only thing that will matter is quality.

Furthermore, Stitch Fix can use all their data to create apparel in-house and cut out their suppliers, creating their platform moat. In a platform moat, no other providers have the content and consumers go to a specific platform for the exclusive content — think Hamilton on Disney+.

All the media companies have been phenomenal at creating platform moats and hint at the transition to come in physical goods. A platform like UberEats, for example, can leverage the massive amount of data from its 8 million+ users to gain unique insight into what kinds of foods are rising in popularity, and then spin up restaurants based on this information. For example, UberEats recognized the poke bowl trend a year and a half before it hit Dallas and presumptively catered to each consumer’s latent demands with a virtual poke restaurant. All it needed was a restaurant name, a full menu, and then it utilizes existing kitchen space to produce food for this virtual restaurant that its fleet then delivers to everyone’s doors.

The Decline of Brands

The power of a brand name seems hard to measure. How much power does the Louis Vuitton or Nike brand give their business? Where does quality play a role? One way you can measure the power of a brand is by asking: Is a consumer willing to pay more for this good or service that is objectively identical from others?

A consumer will pay more for a brand for two reasons:

- The brand name makes them feel good.

We often think that we want nice things because they make us feel good — but more often the case is that we want nice things because it makes us look good, especially when other people want these things.

“What a nice resort.”

Becomes: “What a nice resort I can post on my Instagram.”

“This t-shirt material feels nice.”

Becomes: “Everyone knows I spent $800 on my Supreme shirt.” - The brand name reduces uncertainty.

A brand is a signal for quality (“I buy Toyota because it’s reliable.”). In the Pre-Internet Economy, building this trust and assurance traditionally took time.

Brand power is important in the Real Estate and Internet Economy, but will decline in the Self-Driving Economy. In a world where all goods are consumed in a subscription model that are purchased through go-to platforms, #2 using a brand name to reduce uncertainty about quality, will matter a lot less.

As the Internet Economy transitions to the Self-Driving Economy, the sun passes midday on the brand. Previously, we lived in an era where we deferred to the brands who messaged the loudest. But now, we trust brands based on our social network. Imagine you see a trendy hotel on Instagram. You look for it on Facebook and realize that all your young, cool friends have stayed there, liked the page, written a review—and suddenly, you want nothing more than to spend a night there, too. The path of product discovery has shifted due to social media, and it will shift again.

In the Self-Driving Economy, brands matter less because goods will come in a bundle a platform has personally selected for its consumers. Instead, a consumer’s favorite brand will be what Amazon, Google, Stitch Fix, or UberEats tells them it is.

How platforms weaken the bargaining power of their suppliers

The Restaurant Industry

Chef Alfred owns several restaurants in Maryland. He’s never had a problem with delivery apps and used to see them as an extra source of business. Then, the coronavirus pandemic hit, and now Alfred relies solely on delivery. Apps like Seamless and Grubhub charge as much as 40% in fees. “It’s a huge, huge chunk of our money. Especially because people are just, for the most part, using this money to pay their staff.”

Delivery apps charging exorbitant fees has become such a big problem that San Francisco recently mandated a 15% cap on the fee that delivery providers can charge, with New York and other states following closely in suit with a 20% mandated cap.

Sometimes it seems like we’re making food to make Seamless profitable. [At the same time] it’s really becoming a bulk part of our business, so it’s not something we can cut.

A representative at Curry-Ya, a Japanese restaurant in Harlem

Another New York restaurant owner described delivery as “crack cocaine,” an income stream that his business had become dependent upon but that might ultimately be running them into the ground.

As delivery platforms start gaining market share, they also gain bargaining power over their suppliers, in this case, the restaurants. We could presumably see a future where a restaurant goes out of business from relying on delivery, and then the delivery platform steals their menu and offers it on their platform as a cloud kitchen restaurant. When a platform does not have market share, they charge restaurants low fees subsidized by venture capital. Once the platform gains more market share, and restaurants become reliant on the platform as a growing source of income, the platform has more bargaining power and is able to charge restaurants more for their service.

The Music Industry

Spotify is another example of a platform that has dramatically gained bargaining power. Let’s look at the relationship between artists, record labels, and Spotify. This relationship will enable us to understand the characteristics of players that gain leverage in a Self-Driving Economy and how a new breed of CPG platforms like Stitch Fix can arise and evolve into a single-buyer monopsony with bargaining power over its suppliers.

The labels

There are three record labels — Universal, Sony, and Warner — that own the rights for 70% of the music we listen to. The music industry is an oligopoly — these labels aren’t just a distribution channel for artists. They also have all the bargaining power.

The streaming music service

Then we have Spotify. Spotify buys the music from these labels and pays a royalty fee every time a Spotify user streams a song. This fee can range from $0.003 to $0.008 depending on what was negotiated — and you can imagine Sony, Warner, and Universal group can negotiate these fees up since they own the bulk of Top 40 content and Spotify wants these artists in their catalogue. This ~$0.005 fee gets split up in various ways — the label takes a cut, the singer takes a cut, and the songwriter takes a cut.

The artists

Many artists have been feeling squeezed by the royalty rate. Adele and Taylor Swift took their music off Spotify at points in their careers. Adele chose not to release “25″ on Spotify, and Swift made the same decision with “1989.” Jay-Z took an extra step and bought Tidal, a music streaming service which he hoped to transform into an aspirational artist-first platform. Jay-Z had rapped in a freestyle:

Spotify is nine million, they ain’t say sh-t

Lucy you got some esplainin’ to do

The only one they hatin’ on looks the same as you

That’s cool, I know they tryin’ to bamboozle you

Spendin’ millions on me to try to confuse you.

Tidal aimed to prove that artists with enough clout could enter the age on their own terms by going directly to consumers. Tidal was unsuccessful — the service launched with exclusive content to try and bring fans but didn’t have a large catalogue of content, turning fans off. Tidal still has not managed to gain significant market share in the music streaming industry.

The three-way relationship

Streaming numbers are through the roof, but economics for artists are not. Metallica hit 1 billion streams in 2019, and for $0.003 a stream, Spotify pays them a paltry $3 million a year for one of the most popular heavy metal bands to have ever existed. For comparison, Netflix pays a movie studio several hundred million dollars for one to two years of streaming rights.

Spotify claims not to want to enter the music production business and make their own music because they don’t want to compete with their customers, the music labels. Spotify CEO Daniel Ek has argued that most of the revenue comes from touring, not from music production. Spotify’s biggest cost, however, is the royalties they pay record labels, so they are incentivized to produce original content and cut their cost.

Their public stance is questionable. Spotify has been accused of quietly creating and promoting fake artists to fill their music playlists in order to lower the fees they have to pay the major labels. Vulture has pointed out playlists like Ambient Chill, which features a song from an obscure band called Deep Watch that has no footprint outside of Spotify. Music Business Worldwide published a list of 50 artists with millions of streams it says fit the profile of “fake artists” and suggested that if Spotify wasn’t buying the tracks outright, it may be arranging reduced royalty rates. This strategy allows Spotify to lower the share of music on playlists from the major labels so that Spotify can lower its content costs and squish the influence of the labels.

Platforms like Spotify, Netflix, Stitch Fix, leverage their content producers to figure out what content is valuable, using these insights as a springboard for their own interests. Spotify is no longer just a music player — they are a tastemaker, and increasingly, a producer. As Spotify becomes a producer, the original producers, the record labels, lose the bargaining power they once had. Stitch Fix is an early company that is well-positioned to follow suit, transitioning from a clothing curator to clothing producer. Cheap shipping costs will unlock this transition.

In the background, an ongoing tension between platforms and suppliers arises. On one hand, platforms make it easier for suppliers to jump on and sell their goods, but on the other hand, they also gain an increasing amount of leverage and bargaining power to eventually replace their suppliers.

Where the Opportunities Lie in this New Economy

The transformation of shipping will have ripple effects across every financial and cultural aspect of the retail industry. Given that the retail model is going to drastically change in the next few decades, where are the opportunities in this new economy?

#1: Infrastructure for small businesses

Amazon appears to be the natural platform dominator here. They’ve done what Spotify and Netflix did for music and movies, respectively — except for all consumer packaged goods. Amazon has spent billions of dollars in physical logistics and invested lots of money into the infrastructure. They have a massive advantage, but there are several pitfalls of Amazon’s approach:

- Amazon has been unsuccessful at tackling premium retail.

- For consumers, Amazon is good for commodities — think razors, laundry detergent — but struggles with entering niche spaces, such as luxury fashion. Think about the last time you bought clothing. Chances are, it is more likely it was at a business like an Everlane, Massimo Dutti, or Nordstrom’s — not Amazon.

- For merchants, those selling luxury clothing and other goods want control over the customer experience — they want to control the way you feel when you browse for a new Chanel bag and ensure it remains a premium experience. Amazon’s brand perception has been the reason for its struggle for years of trying to break into the luxury fashion industry.

- For consumers, Amazon is good for commodities — think razors, laundry detergent — but struggles with entering niche spaces, such as luxury fashion. Think about the last time you bought clothing. Chances are, it is more likely it was at a business like an Everlane, Massimo Dutti, or Nordstrom’s — not Amazon.

- Amazon’s aggressive practices have garnered negative merchant sentiment.

Even with commodity retail, merchants have been increasingly pulling off the Amazon platform as Amazon takes higher fees and launches competitor products. Merchants use Amazon because Amazon takes care of marketing and demand generation for them, as well as fulfillment. But merchants have been slowly turning against Amazon, because of the high fees they charge and their egregious practices of profit at all costs, and have been pulling their products off. One merchant says, “They started advertising their Amazon razors on my page” before they took their products off Amazon.

Stratechery’s Ben Thompson has an excellent post that describes Shopify’s platform play from a systems level, but I’d like to offer a simpler perspective to explain why Shopify could eventually outcompete Amazon.

While Ben examines the retail space from a systems level, we’ll examine it from a merchant perspective — how does a seller choose where to sell their goods? Currently, merchants have two choices:

- Amazon – they generate demand for you, but you pay high fees

- Shopify – you generate demand yourself, and pay low fees

At first, the decision seems simple: what tradeoff do you want to choose? In this scenario, there might be space for two players. It starts getting interesting when a player is able to both generate demand for you, and offer low fees.

Move over, Amazon

Shopify recently acquired Kit, a virtual marketing assistant that they are integrating into their product. Here’s how it works: you connect to your business’s Facebook page, you tell them who you’d like to target, and they help run Facebook ad campaigns and create look-a-like audiences for you. Kit is free for all their members for their platform. Right now, Shopify Kit focuses only on Facebook ad campaigns. But it becomes much more interesting once you think about expanding its marketing channels to serve all of an ecommerce business’s demand generation needs.

Autonomous shipping infrastructure for businesses

What the Self-Driving Economy will enable is for other retailers to be able to also quickly spin up their own retail company. Opportunities lie in those enterprises that can provide this infrastructure that retailers can plug into (just like AWS). Nuro is a little known automated shipping company who is well positioned for this. But they are slowly rising — they recently partnered with Wal-Mart to offer autonomous grocery delivery. With their extensive fleet, they’ll be able to offer retailers a zero-capital automated solution for distributing products.

Starship is another exciting company that does autonomous food delivery for businesses. Their robots deliver food from local restaurants to anywhere customers choose. Companies like Nuro and Starship will become a more enticing service for individual restaurants and suppliers as the platforms use their bargaining power to strangle restaurants. China provides a glimpse of what could happen in the US. Chinese food delivery apps have recently faced a backlash from restaurants, who are tired of the high commission charge. Some of these restaurants have started to build their own delivery platforms for takeaway orders and are using delivery services to get orders to their customers instead.

#2: Retail aggregators

A second opportunity area are retail aggregators. Think Stitch Fix aggregating clothing retailers and WayFair aggregating furniture retailers. Stitch Fix’s growing mountains of data about consumers’ tastes in clothing allow them to apply a quantitative approach to something we normally think of as qualitative: fashion. From the experiences of more than 3 million active clients, Stitch Fix knows what a customer would like and spend money on. Stitch Fix has even started their own in-house clothing brand, Hybrid Designs, to fill product gaps in their marketplace. For example, many female clients in their mid-40s were asking for capped-sleeved blouses, but that style was missing from their inventory. They soon used that data to design blouses to match the tastes of the consumer data collected, filling their client needs.

The “Retail Sweet Spot” framework

Not every company can just enter into this space and win, however, an enterprise requires three qualities to succeed in this space:

- High volumes of data on consumer preferences

- Low overhead expense when they get it wrong – For Amazon, for example, it can be pretty costly when they get an order wrong because they have to cover return shipping per item. For Netflix, on the other hand, the cost when a consumer decides they don’t like a movie is really cheap, especially because Netflix pays for streaming rights on a time-based basis).

- Research is unimportant in the buying decision of the customer – There are some CPGs where research matters a lot and is part of the buying process (e.g. make-up) and there are other areas where research matters less (e.g. laundry detergent).

Conclusion

The Self-Driving Economy will do for physical goods what the internet did for streaming. Before streaming, you had to download music and movies one at a time. Now, consumers will effectively stream over the network Self-Driving infrastructure companies are creating. This will make it possible for consumers to access things they didn’t even know they liked.

At every level of the three economies, the line between being a superfan and a casual fan becomes increasingly blurred. In the Real Estate Economy, the only people who would buy records were super fans — you’d go through the effort of visiting a record store and buying a record only if you were a hard core fan of Madonna or Bruce Springsteen. But now in the Internet Economy with Spotify, many casual fans can discover and freely enjoy a wide variety of music — listeners listen to music they would not have before, because it is included in their bundle.

When a cost is dramatically driven down (in this case, shipping costs), the market dynamic changes in such a way that what can be actually delivered to consumers changes. In China, where food delivery is cheap, there are many more businesses and even individuals who can now enter the market — from small restaurant owners to casual home cooks who want to experiment and share their food with others; they simply hop on the platform. On the consumer end, there are interesting implications when takeout becomes cheaper than cooking. Perhaps kitchens won’t have to be built into homes anymore and it will change our housing sizes and the structure of cities. Perhaps if any food can be brought to you without ever having to go out to the restaurants and the like, Gen Z will find the suburbs more appealing.

An invention can supercharge growth in previously unrelated industries

These possibilities lead to a broader insight. Ford’s first affordable automobile, the Model T, transformed American manufacturing and later drove urban sprawl — suddenly, everyone was mobile. This altered many industries directly — auto parts and steel mining, for example — but there were also many industries affected that were completely unrelated to transportation. The mass adoption of an affordable personal car meant people could drive and stay at far away places that they couldn’t before — leading to the booming of the hotel and vacation industry.

The second-order effects and economies of the Model-T far outnumber and outweigh the automotive industry implications. Similar to flights, trains, and transit, the businesses themselves may not be super profitable at all (the automotive sector’s profit margins are 10.49%), but the second-order effects in downstream industries can be insane (the hotel industry makes a 53.34% profit margin). In a similar way, the second-order effects of the Self-Driving Economy will far outweigh the autonomous, electric vehicle hardware implications.

| Industry | Gross margin |

| Automotive sector | 10.49% |

| Hotel sector | 53.34% |

Auto vs. Hotel industry margins

Industry growth and new customer adoption will be driven over the coming years by relentless improvements to the customer experience of shopping. Instead of being driven by increases in bandwidth, disk space, and processing power, as they have in the past, they will be driven by innovations in electric, autonomous vehicle hardware, all of which are orders of magnitude cheaper than their incumbent counterparts. What the Internet did for the free flow of information, the Self Driving Economy will do for the free flow of goods.

Thank you for reviewing early drafts of this: Alexis Kim, Irfan Faizullabhoy, David Perell, Kathleen Martin, Elain Szu, Chris Pagliarella, Packy McCormick, Savannah Perkins, Suthen Siva, Mandeep Minhas, James Early, Steph Sher, Kurt Spindler, Rhys Lindmark.